What does Vacant Home Tax mean for homeowners in Toronto?

Starting in the year, 2023 City of Toronto implemented a Vacant Home Tax (VHT) to increase the housing supply by discouraging owners from leaving their residential properties unoccupied. Homeowners who keep their properties vacant will be subject to this tax. Nava Wilson’s team conducted a structured overview of what a Vacant Home Tax (VHT) is and what it means for homeowners in Toronto.

* Repairs or renovations.

The vacant property is undergoing repairs or renovations, and all the following conditions have been met:

a) occupation and normal use of the vacant property is prevented by the repairs and renovations;

b) all necessary permits have been issued for the repairs and renovations;

c) the City’s Chief Building Official is of the opinion that the repairs or renovations are being actively carried out without unnecessary delay.

* Repairs or renovations.

The vacant property is undergoing repairs or renovations, and all the following conditions have been met:

a) occupation and normal use of the vacant property is prevented by the repairs and renovations;

b) all necessary permits have been issued for the repairs and renovations;

c) the City’s Chief Building Official is of the opinion that the repairs or renovations are being actively carried out without unnecessary delay.

What is considered a vacant property?

A property is considered vacant if it was not used as the principal residence by the owner(s) or any permitted occupant(s) or was unoccupied for six months or more during the previous calendar year. Properties may also be deemed (or considered to be) vacant if an owner fails to declare occupancy status as outlined in the by-law.Who the Vacant Home Tax applies to?

All Toronto residential property owners must annually state their property’s occupancy status, even if occupied by the owner. Declarations are the responsibility of the owner or someone acting on behalf of the owner and will determine whether the Vacant Home Tax applies and is payable. Even though all homeowners are required to submit a declaration of occupancy status, the tax does not apply to:- properties that are the principal residence of the owner

- properties that are the principal residence of a permitted occupant or tenant

- properties that qualify for an exemption

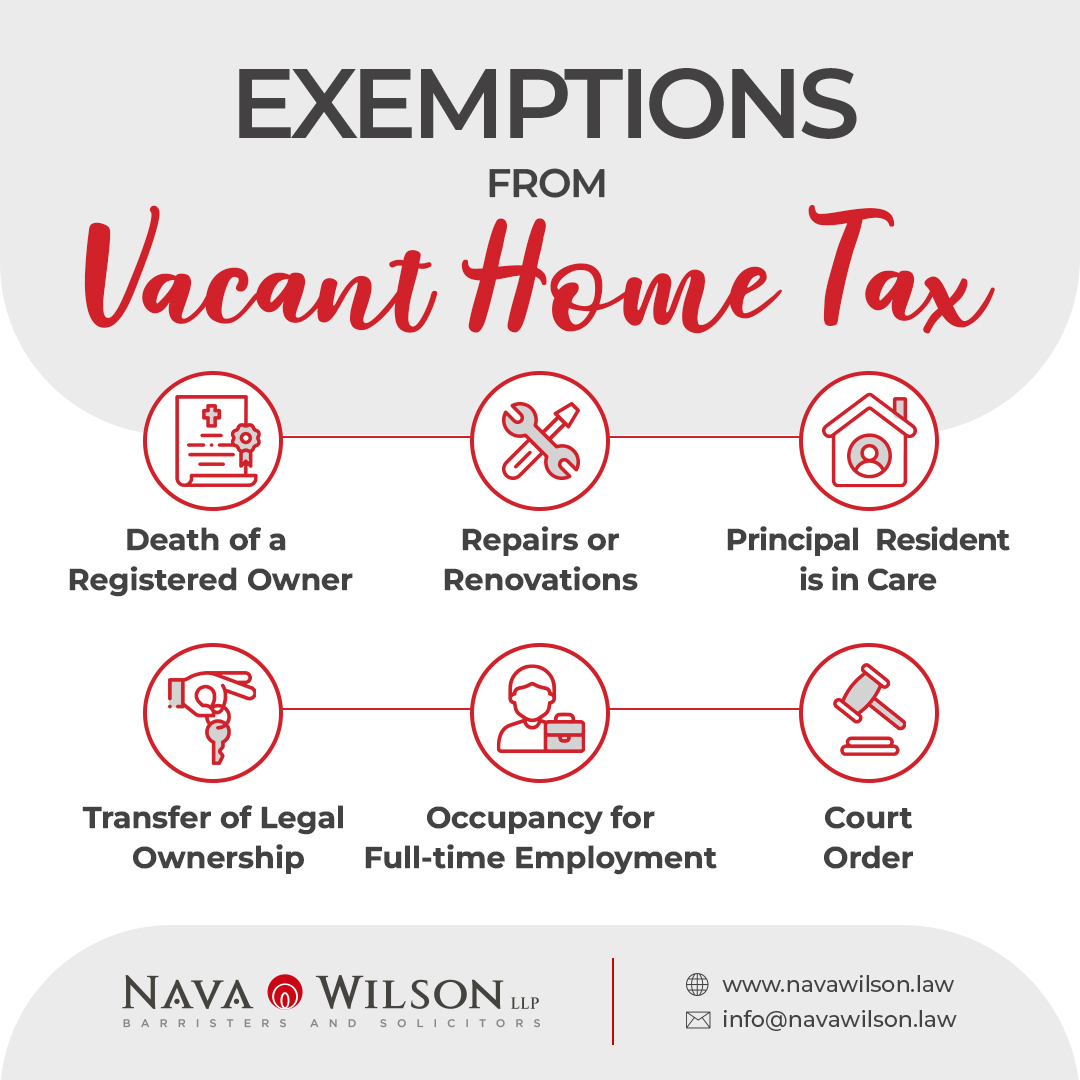

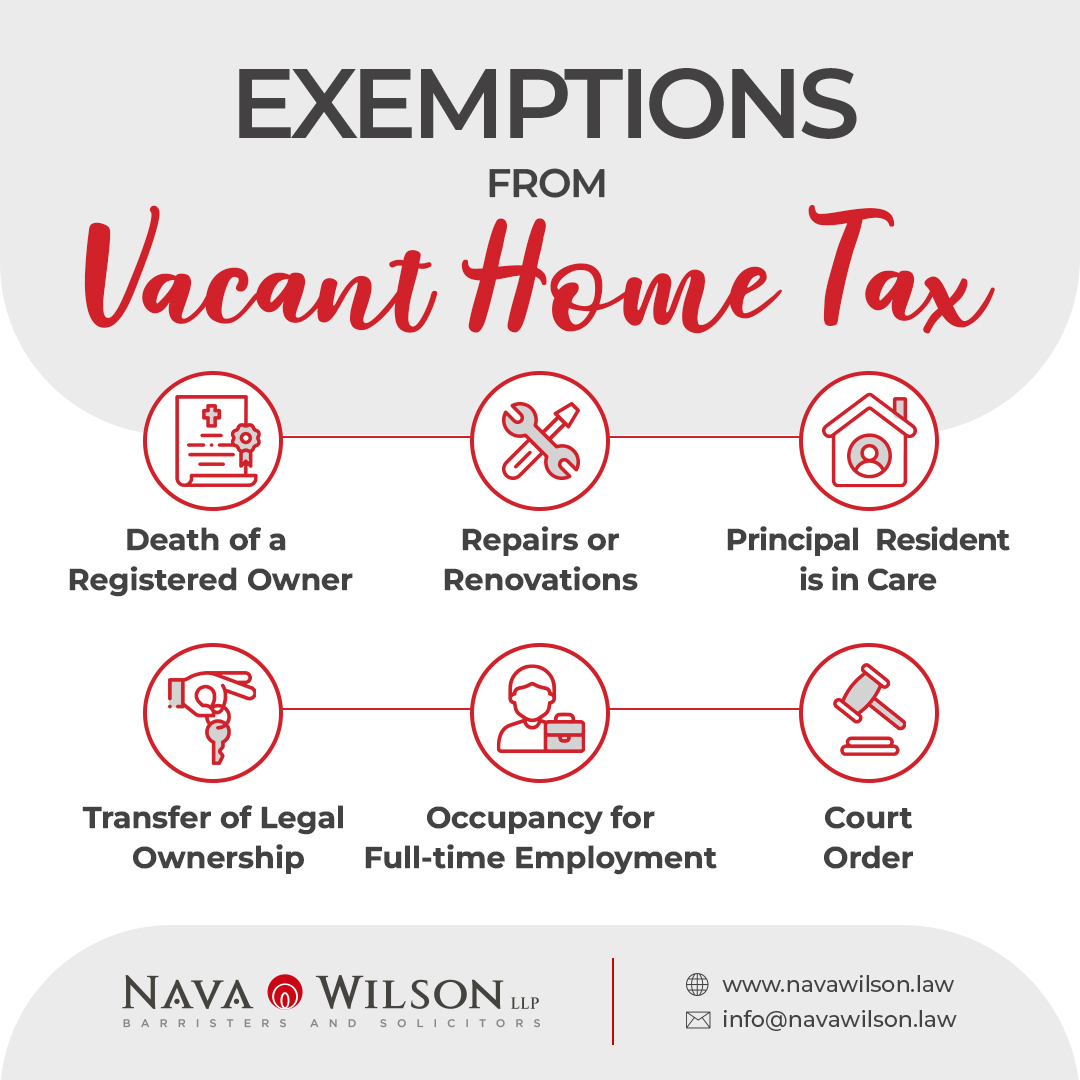

Exemptions from Vacant Home Tax.

There are some cases where a property may be left vacant, and an individual is exempt from the Vacant Home Tax. According to the by-law, a declaration will not be required if the property does not contain a residential unit (for example, vacant land, parking space or condominium locker). Important to note: A residential unit is comprised of one or more self-contained units that include a dedicated washroom and kitchen. * Repairs or renovations.

The vacant property is undergoing repairs or renovations, and all the following conditions have been met:

a) occupation and normal use of the vacant property is prevented by the repairs and renovations;

b) all necessary permits have been issued for the repairs and renovations;

c) the City’s Chief Building Official is of the opinion that the repairs or renovations are being actively carried out without unnecessary delay.

* Repairs or renovations.

The vacant property is undergoing repairs or renovations, and all the following conditions have been met:

a) occupation and normal use of the vacant property is prevented by the repairs and renovations;

b) all necessary permits have been issued for the repairs and renovations;

c) the City’s Chief Building Official is of the opinion that the repairs or renovations are being actively carried out without unnecessary delay.

Who is responsible for making the declaration after the change of ownership?

- 1. Seller – Residential properties closing between January 1st and February 2nd (the declaration deadline in Toronto) are Seller’s responsibility to declare.

- 2. Buyer – The buyer’s responsibility is to declare residential properties closing from February 3rd to January 31st. The purchaser qualifies for the “transfer of legal ownership” exemption.

How to declare?

Homeowners should make the declarations of occupancy status through the City’s secure online declaration portal. If required, homeowners can complete a paper declaration form instead. The deadline is February 2nd, 2023. Additionally, the City of Toronto may require an audit for residential properties not occupied by the homeowner(s). To make a declaration, you will need your 21-digit assessment roll number and customer number from your property tax bill or property tax account statement. If the owner fails to make the annual declaration by the deadline and/or provide supporting documentation, residential properties will be deemed vacant. Important to note: According to the City of Toronto, making a false declaration or failure to declare may result in a fine of $250 to $10,000. “Exemptions under the by-law require clarity and expansion. Until this happens, many homeowners will likely be liable to pay the tax. For example, a tenant is deemed to be a person who occupies the unit pursuant to a written lease or sublease. However, there are many unwritten tenancies. Do these fall under the exemptions? It’s still unclear. All lawyers for purchasers need to insist on delivery of a filed declaration to the city from the sellers, prior to closing to avoid post-closing surprises.” – says Sutharsan Vasanthan, Associate Partner at Nava Wilson.Paying the Vacant Home Tax (VHT).

Owners must pay the Vacant Home Tax if residential properties are declared vacant for six months or more during the taxation year without an eligible exemption. The owners of vacant properties subject to tax will receive a Vacant Home Tax Notice in March/April with a due date of May 1st. You can make the Vacant Home Tax payment at banks or financial institutions through online banking, telephone banking, at an automated teller machine (ATM) or in person. However, to ensure that payment reaches the City of Toronto on or before the due date, it is recommended to make the payment electronically through MyToronto Pay or a financial institution’s online banking portal.List of financial institutions you can use to pay the Vacant Home Tax through online banking:

- 1. Scotiabank

- 2. RBC (Royal Bank of Canada)

- 3. National Bank

- 4. BMO (Bank of Montreal)

- 5. CIBC (Canadian Imperial Bank of Commerce)

- 6. TD Canada Trust

Making a Notice of Complaint.

Suppose you, as a homeowner, disagree with the Vacant Home Tax Notice or Supplementary Assessment Notice. In that case, you may file a Notice of Complaint, and the City will review your property’s status.Your complaint must be received within the following time frames:

- Vacant Home Tax Notice: On or before the 10th business day of April in the year following the date that payment was due.

- Supplementary Assessment Notice: Within 90 days of the date on your notice.

Your Notice of Complaint can be submitted through the online portal and must include the following:

- Assessment roll number and customer number.

- Complainant’s full name and contact details (telephone number or email).

- If you are a complainant acting on behalf of the owner, include information that specifies your authority to act on their behalf.

- Reason(s) for the complaint and why the residential property should not be subject to the tax.

- Supporting documentation and evidence to substantiate the reason(s) for the complaint.